DEVELOPMENT OF ISLAMIC COMMERCIAL BANKS IN INDONESIA

DOI:

https://doi.org/10.47353/bj.v4i6.431Keywords:

Development of Islamic Commercial Banks, Economy, Covid-19 PandemicAbstract

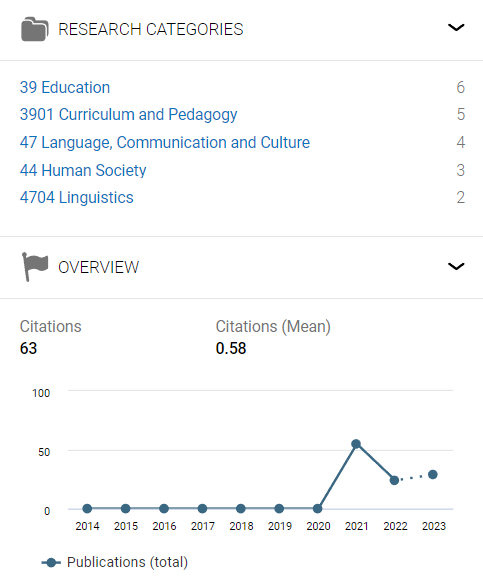

The corona virus has had a fairly broad impact on community activities, one of which is the impact on economic activities in banking financial institutions, both in conventional banks and Islamic banks. The type of research used is field research. This research is descriptive qualitative, which means it describes a research subject. The data analysis technique used in this study, the author uses qualitative descriptive analysis. The growth of Islamic Commercial Banks during the Covid-19 pandemic in 2020 decreased and began to recover in 2021. In the problematic financing component, there was a decrease in the risk of problems until 2021, due to more selective financing distribution. The results show that the DPK indicators, which include savings, current accounts and deposits, experienced a setback in 2020 and recovered again in 2021. Thus, it can be concluded that Sharia Commercial Banks are also faltering with the presence of the Corona outbreak that has hit the world, post-Covid-19 development of Sharia Commercial Banks began to slowly recover with increasingly improving performance.

Downloads

References

Azhari, M., & Wahyudi, I. (2020). Pandemi Covid-19 dan Dampaknya terhadap Kinerja Perbankan Syariah. Journal of Islamic Economics and Finance, 6(2), 123–134.

Diamond, D. W., & Dybvig, P. H. (1983). Bank Runs, Deposit Insurance, and Liquidity. Journal of Political Economy, 91(3), 401–419.

Fauziah, H. N., Fakhriyah, A. N. and Abdurrohman (2020) Analisis Risiko Operasional Bank Syariah Pada Masa Pandemi Covid-19, Jurnal Ekonomi dan Perbankan Syariah, 6(2), pp. 38–45.

Iskandar, A., Possumah, B. T. and Aqbar, K. (2020) Peran Ekonomi dan Keuangan Sosial Islam saat Pandemi Covid-19, SALAM: Jurnal Sosial dan Budaya Syar-i, 7(7), pp. 625– 638.

Mawarni, R., & Iqbal Fasa, M. (2021). Optimalisasi Kinerja Digital Banking Bank Syariah di Masa Pandemi Covid-19. Jurnal Manajemen Bisnis (JMB), 34(1), 1–13.

Mishkin, F. S., & Eakins, S. G. (2018). Financial Markets and Institutions (9th ed.). Pearson.

Siregar, E. S., & Siregar, F. A. (2020). Menakar Potensi Bank Syariah Di Indonesia Pada Masa Covid-19. Al- Masharif: Jurnal Ilmu Ekonomi Dan Keislaman.

Sofyan, R. (2011). Bisnis Syariah Mengapa Tidak?. Gramedia Pustaka Utama.

Sugiri, D. (2020). Menyelamatkan Usaha Mikro, Kecil dan Menengah dari Dampak Pandemi Covid-19, Fokus Bisnis : Media Pengkajian Manajemen dan Akuntansi, 19(1), pp. 76–86.

Tahliani, H. (2020). Tantangan Perbankan Syariah dalam Menghadapi Pandemi Covid-19, Madani Syari’ah, 3(2), pp. 92–113.

Uyun, A. (2021). Role of Islamic Banking and Existance of MSMEs in Indonesia After Covid-19 Pandemic. Journal of Economic Sharia Law and Business Studies. 1(1). 57-69.

Yanti, A., Arfan, M., & Basri, M. (2018). Strategi Inovasi Perbankan Syariah Menghadapi Krisis Ekonomi Global. Jurnal Ekonomi Islam, 5(1), 87-97.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Retno Dwi Zulaikah

This work is licensed under a Creative Commons Attribution 4.0 International License.